Tax Details

Taxes are an important part of the discussion as families advocate for a budget solution that avoids school closures.

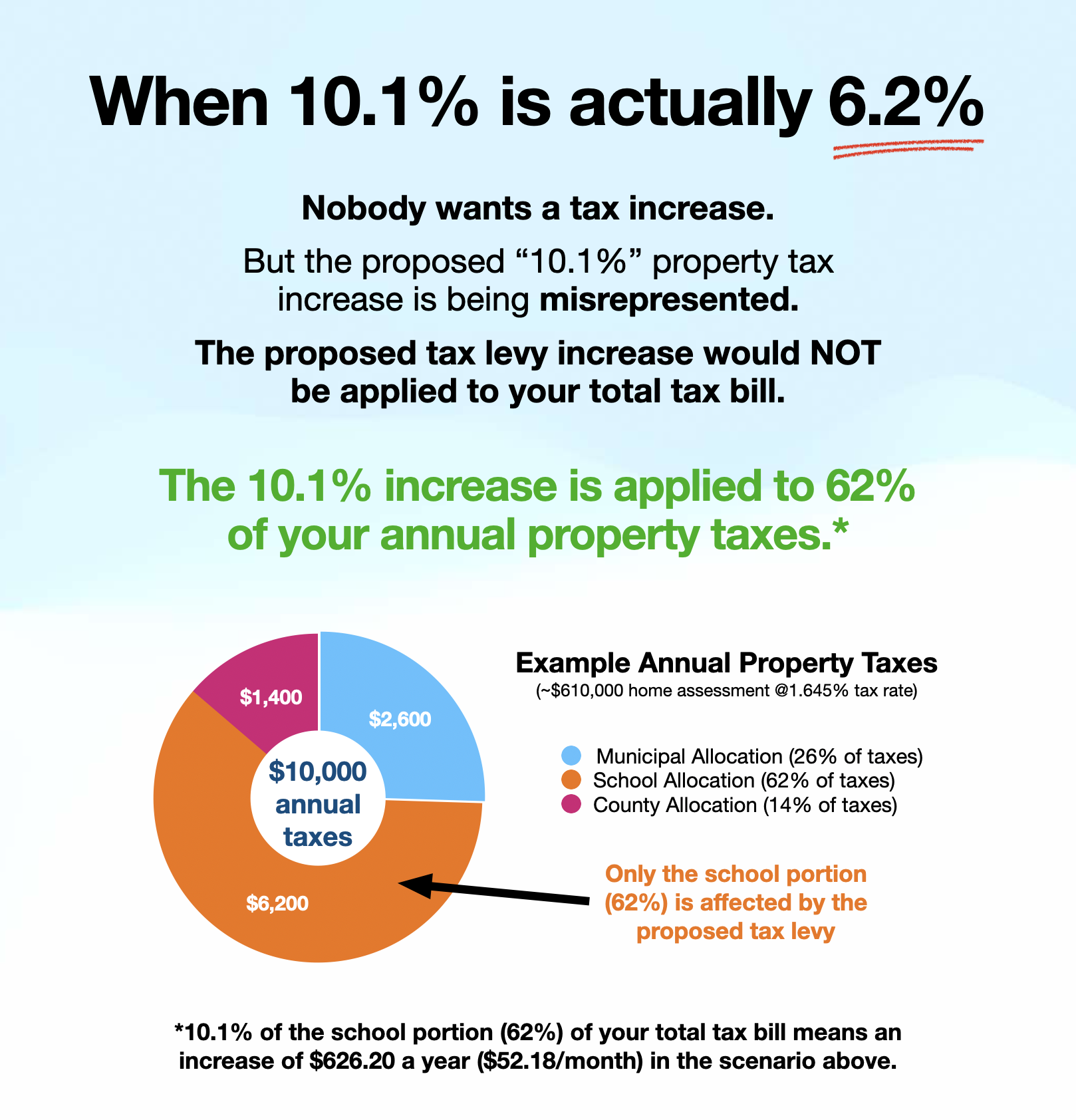

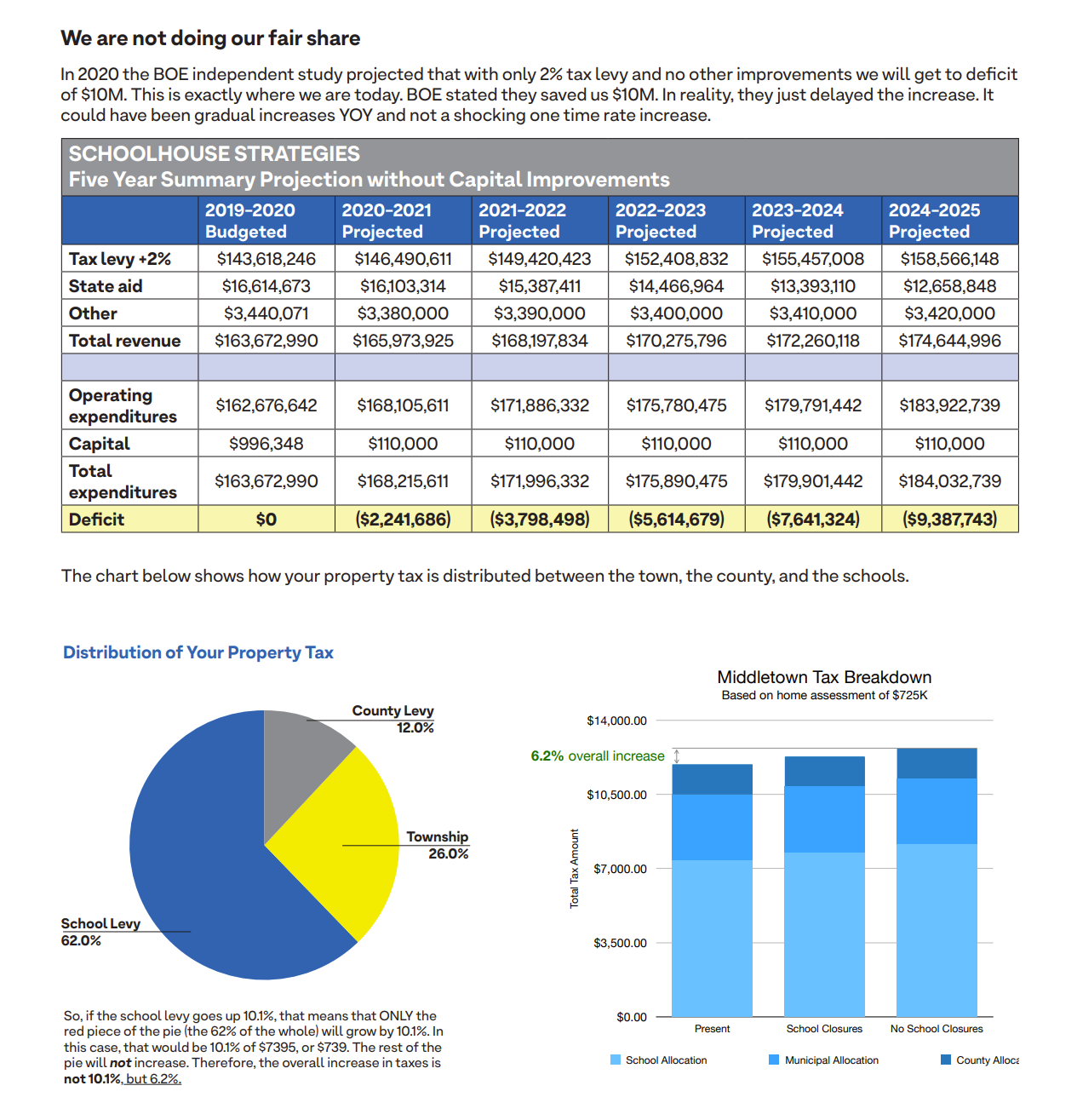

The surprise school closure plan that Middletown School Superintendent Jessica Alfone unveiled on March 18 proposed a nearly 5 percent increase in the district’s tax levy. This increase just applies to the school district’s share of local property taxes, not your entire bill (which also includes municipal and county government levies).

After parents fought back against closures, Alfone on March 21 said the district could increase the levy by another 5.2 percent to raise additional revenue. That’s where we are, but there’s more to the story….

And yes, you read that correctly. School officials seem uninterested in explaining this, but the tax levy increase floated on March 21 would not be 10 percent.

The difference in some cases winds up being less than a dollar a day compared to the school district’s Plan A, which would mean devastated neighborhoods, overcrowded classrooms, layoffs and the hidden costs of actually implementing the closures and redistricting.

No one wants to pay more in taxes, not seniors on fixed incomes or families with school-age children. However, even if this was just about keeping taxes as low as possible, closing schools will severely backfire. Here’s why:

Closing schools will tank Middletown’s property values.

Lower property values mean less tax revenue, creating new deficits that force more cuts and more closures. This isn’t speculation, it’s how school closures have played out elsewhere.

Save Middletown Schools has urged district leaders to act in good faith and explore all reasonable budget alternatives. As the conversation unfolds, the community deserves detailed context for every proposed solution, free from gamesmanship.

No solution ultimately chosen by the board should mean closing schools.